Duke Energy, the nation’s largest power producer, will dramatically slash coal generation’s share from the current 22% of total generation to 5% by 2030 and achieve a full phaseout of unabated coal by 2035. The company instead expects to deploy more than $ 130 billion over the next decade—$ 63 billion of which it will spend over the next five years—to fund investments in grid modernization and efforts to replace its coal fleet with renewables, natural gas, and emerging technologies.

The ambitious goals, unveiled as part of an expansion of Duke Energy’s “clean energy action plan” on Feb. 9, will keep the company on track to achieve 2020-announced commitment to reduce its greenhouse gas emissions (GHG) by at least 50% by 2030 and to achieve net-zero emissions by 2050, it said. Under the plan, the company will expand its 2050 net-zero goals to include Scope 2 and specific Scope 3 emissions.

“In its electric business, the company’s net-zero goal will include greenhouse gas emissions from the power it purchases for resale, from the procurement of fossil fuels used for generation and from the electricity purchased for its own use,” the company explained. “For the natural gas business, it means adding a new net-zero by 2050 goal that includes upstream methane and carbon emissions related to purchased gas and downstream carbon emissions from customers’ consumption.”

The “scope”–oriented benchmarks are set by the Greenhouse Gas Protocol, an international collaboration established to create and manage global standardized GHG management frameworks. Scope 1 is defined as direct emissions from the company. Scope 2 emissions are indirect emissions from power the company purchases from others to use in its facilities, while Scope 3 includes indirect emissions that arise from other sources in the company’s value chain.

Duke Energy Has Retired 7.5 GW of Coal-Fired Generation Since 2010

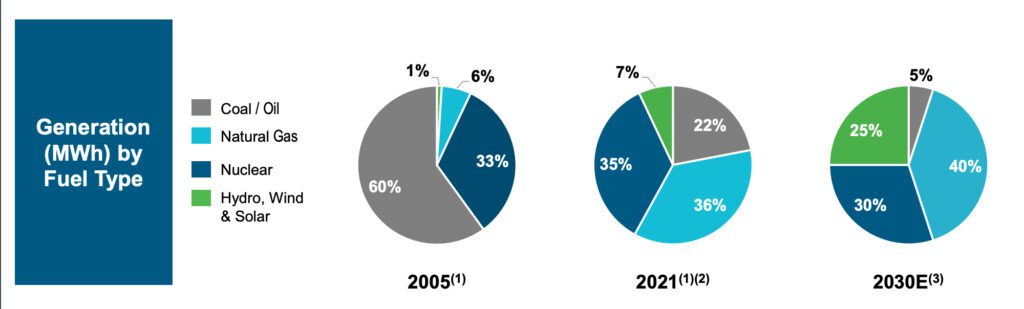

Duke Energy has already reduced its Scope 1 carbon emissions from electricity generation by 44% from 2005 levels. The majority of these reductions have been achieved through the retirement of 56 coal units—a combined 7.5 GW—since 2010.

“In 2021 alone, we retired five coal units, three in North Carolina and two in Indiana, that generated 957 MW of energy,” Duke Energy spokesperson Heather Danenhower told POWER. “By year-end 2025, we plan to retire three additional coal units—965 more megawatts from coal generation—bringing our coal plant retirements to about one-third of our former coal fleet.”

Over the next decade, Duke Energy will also continue to reshape its portfolio in accordance with state regulatory efforts. The company is, for example, slated to submit a carbon plan in May 2022 to comply with North Carolina’s House Bill 951, landmark legislation that provides a framework to achieve a 70% carbon reduction by 2030.

“The plan we submit will have multiple portfolios that weigh the costs and benefits, including reliability and affordability of various resource types,” said Lynn Good, Duke Energy Corp. chair, president, and CEO, during a fourth-quarter 2021 earnings call on Feb. 10. “We will also evaluate with stakeholders and our regulators the full range of potential risks and opportunities related to new clean energy technologies. We expect an order on the carbon plan by the end of this year.”

An integrated resource plan (IRP) recently submitted to regulators in Indiana also envisions a dramatic spate of coal retirements. “Our preferred scenario reduces carbon emissions from our Indiana fleet by 63% by 2030 and 88% by 2040 compared to 2005 levels. It adds over 7 GW of renewables over the 20-year horizon and accelerates the retirement of coal generation with a targeted exit from coal by 2035. This plan also includes natural gas and a prudent amount of market purchases for capacity and energy requirements,” Good said.

By 2035, only one coal plant could be operational—the Edwardsport integrated gasification combined cycle (IGCC) plant. The Indiana IRP surveys multiple operating conditions for the plant—the newest coal plant in the company’s fleet—including switching it entirely to natural gas or equipping it with carbon capture. A complete switch to natural gas, however, is “virtually a permanent decision and very difficult to reverse,” the IRP notes. “There are required air permitting changes, loss of specialized workforce for the gasification process, coal contract issues and operational challenges with restarting on coal.” Running Edwardsport at least until 2035 is the best option because it offers reliability through its dispatchable, onsite fuel source for the Midcontinent Independent System Operator region, the IRP argues.

To boost its prospects for a “responsible transition,” Duke Energy Indiana on Feb. 17 issued a request for proposals for up to 1.1 GW of intermittent generation, including renewable-battery hybrids, and 1.3 GW of dispatchable power, including natural gas combustion turbines, combined-cycle units, and stand-alone battery units. The request called for existing and proposed resources within the MISO Zone 6 region that will be in service by June 2027.

Nuclear, Hydrogen, Carbon Capture on the Horizon

While Duke Energy currently produces only 7% of its total generation from renewables, and 36% from natural gas power, by 2030, it expects gas’s share will rise to 40%, while renewables’ will soar to 25%. “Embedded within Duke Energy is a top 10 U.S. renewable energy company. We now own, operate, or [have] purchased more than 10,000 MW of solar and wind energy. We plan to reach 16,000 MW by 2025 and 24,000 MW by 2030,” Good said.

Over the longer term, Duke Energy is exploring how alternative technologies could fit into its portfolio. Currently, Duke Energy is partnering with Siemens and Clemson University on a Department of Energy–backed study to evaluate hydrogen integration and utilization at Duke Energy’s Clemson combined heat and power plant. The pilot project, which began in March 2021, is evaluating 30% co-firing of hydrogen in 2024 and 100% firing of hydrogen on or before 2030.

Advanced nuclear could also play a role. Duke Energy provides consulting and “advisory in-kind” services for the 500-MW Natrium sodium-cooled fast reactor plant at PacifiCorp’s Naughton Power Plant site in Wyoming. That project is expected to be operational by 2028.

Under another project, Duke Energy is testing Honeywell’s new flow battery technology, which can store and discharge electricity for up to 12 hours—exceeding the duration of four-hour lithium-ion batteries. Honeywell is expected to deliver a 400-kWh unit to Duke Energy’s Emerging Technology and Innovation Center in North Carolina this year. Duke Energy also plans to begin testing an EOS zinc-bromine Znyth Gen 3.0 battery in late 2022.

Asked about a timeframe for Duke Energy to begin incorporating these technologies in its business, Good said the “awareness” of what might be possible with hydrogen; advanced nuclear; and carbon capture, storage, and utilization (CCUS) is already part of conversations with all its regulators. “The good news is we believe we have runway with existing technologies to achieve the majority of our aspirations around clean energy transition over the next five years or so,” she said. These technologies could begin to grow more significantly in the 2030s when it “would be more important to get to net-zero and the next tranche of carbon reduction,” she added. “And so, I think time will tell on whether they get to commercial scale,” she said.

Good also pointed to federal infrastructure funding dedicated to developing these technologies and bringing them to scale. “So, it’s possible it occurs even more rapidly. But we will be thoughtful, working with stakeholders and our regulators before we begin introducing any of these technologies, so that we have a common view of what we would like to achieve and invest in to meet our goals,” she said.

Mounting Shareholder Pressure

Duke Energy’s transformation appears to be more solidly driven by a combination of factors, including pressure from shareholders to improve its environmental, social, and governance (ESG) posture. In November, shareholders represented by non-profit advocacy group As You Sow resolved to ask Duke Energy to revise its net-zero target and incorporate Scope 3 value chain emissions. As You Sow pointed to Duke Energy’s “peer utilities,” including Xcel Energy, which recently incorporated its customers’ use of natural gas into its net-zero target. Sempra also recently set net-zero targets that cover full value chain emissions, and PSEG has said it will include customer use of natural gas as part of its net-zero commitment to the Science Based Targets initiative. As You Sow has filed similar resolutions with DTE Energy, Dominion Energy, and Southern Co., requesting the inclusion of the full range of Scope 3 emissions in net-zero targets.

Daniel Stewart, energy program manager of As You Sow, told POWER that shareholders are more prominently watching value chain emissions because though they account for a third to more than half of utilities’ emissions, they are currently not accounted for in the vast majority of industry climate targets. Customer use of natural gas for heat in residential and commercial buildings makes up 10% of U.S. GHG emissions, and more than 50 cities in California—and recently New York City—have passed plans to phase out natural gas in buildings and support building electrification to reduce emissions, he noted.

Last week, Good told analysts the company was balancing the myriad demands. “We delivered on our commitments while also strategically positioning the company for the future, de-risking investments, simplifying our business, and modernizing our regulatory frameworks,” she said. “We have a clear vision to meet the needs of our customers and communities while remaining a strong steward of the environment. We believe this strategy will deliver strong, consistent, and enduring benefits to our customers, communities, and investors,” she said.

As You Sow’s Stewart lauded the effort. “We applaud Duke’s decision to strengthen its net-zero commitment to encompass all of its major emissions,” he said. “As the country’s largest power producer, Duke’s announcement is momentous and demonstrates a shift in industry ambition. This is the sort of climate leadership investors want to see from the energy industry.”

—Sonal Patel is a POWER senior associate editor (@sonalcpatel, @POWERmagazine).

Updated: Adds details about coal retirements in 2021 and planned retirements through 2025.

The post Duke Energy Eyeing Coal Phaseout by 2035 appeared first on POWER Magazine.