The post Coal-Fired Generation Down 30% in U.S., 8% Worldwide appeared first on POWER Magazine.

Analysis from a global energy organization said power generation from coal-fired units fell 8.3% in the first half of 2020, with the world’s coal fleet running at less than half its capacity. The drop for U.S. coal generation was more steep, with the U.S. Energy Information Administration (EIA) reporting the output from the nation’s coal units was 30% lower this year compared to the first six months of 2019.

The Ember group, a UK-based think tank, said the global drop was in part due to significantly lower demand for power during the coronavirus pandemic, and coal’s share of generation also was eroded by increased production of electricity from renewables such as solar and wind. Investments in renewable energy continue to increase worldwide as wind and solar power have become competitive with fossil fuel-fired generation.

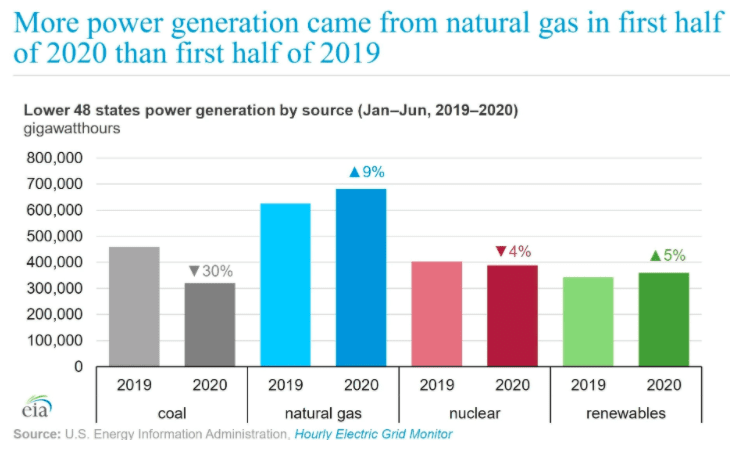

Ember’s global half-year electricity analysis, released August 13, comes at the same time as the EIA’s latest Short-Term Energy Outlook (STEO), published Tuesday. EIA forecasts 3.6% less electricity consumption in the U.S. in 2020 compared to last year, with much of that drop impacting coal. The agency said it estimates that U.S. coal consumption will decrease by 26% in 2020 compared to a year ago. EIA said about 90% of coal use in the U.S. comes from the power generation sector, driving the 30% drop in electricity output in the January–June period (Figure 1).

This year’s lower numbers come after EIA reported that U.S. coal-fired power generation fell to a 42-year low in 2019, with a 16% drop from 2018.

Move Away from Fossil Fuels

U.S. utilities continue to move away from fossil fuels to meet government-mandated clean energy targets, and due to economics, as coal becomes increasingly uneconomic. Schuyler Baehman, a spokesperson for Southern Co., earlier this year told POWER the company is “aggressively growing our investment in renewable energy,” noting Southern is the second-largest owner of solar power outside of China.

Southern is among the generation companies that have set carbon-reduction goals. “On an enterprise-wide basis, Southern Co. has set a long-term goal of low- to no-carbon operations by 2050,” Baehman told POWER. “On our path to 2050, we have established a goal of [a] 50% reduction from 2007 levels in CO2 emissions by 2030.”

The Ember analysis said solar and wind produced a new high of 10% of electricity worldwide in the first half of 2020. The report said that even with the large drop in power demand due to the coronavirus pandemic, renewable energy produced 1,129 TWh of electricity in the January–June period, compared with 992 in the first six months of 2019. Ember noted that the percentage of power produced from wind and solar has more than doubled from 4.6% in 2015, the year of the Paris accord on climate change.

Several of the world’s major economies, including the U.S., China, Japan, and India, now generate at least 10% of their electricity from wind and solar, according to Ember. The group said the European Union now gets one-third of its power from renewables, and Britain receives about 21% of its power from solar and wind.

Coal Restarts in Britain

Interestingly, Britain on Wednesday saw the end of a string of 55 consecutive days without the use of electricity from coal. National Grid said it started a coal-fired power station for the first time in nearly three months, as a record-breaking heatwave continues to tax gas-fired units, and has brought wind generation almost to a halt. National Grid said it brought Uniper’s 2,000-MW Ratcliffe-on-Soar power station in Nottinghamshire online to help support increased power demand.

The Ratcliffe station is one of the UK’s few remaining coal-fired power plants. The government has ordered all coal units to shut down by 2025.

Wind power accounted for about 30% of Britain’s generation in the first quarter of 2020, but was responsible for just 4% of generation on Wednesday. The UK this week had its hottest August day in 17 years, with temperatures climbing to near 100F. London this summer has recorded its longest stretch of record and near-record temperatures in almost 60 years.

National Grid said on Twitter on Wednesday that the Ratcliffe start-up “brings to an end the coal free run, but Britain has operated for almost 3,300 hours without coal so far in 2020—over 60% of the year.”

EIA in the STEO published Tuesday said the commercial sector accounts for the bulk of this year’s decline in power demand. The agency said it expects retail sales of electricity to commercial enterprises will fall by 7.4% this year, in addition to a 5.8% drop in retail sales to industry. EIA said it expects retail sales to the residential sector will rise by about 2% this year.

The agency, perhaps expecting a lessening of the coronavirus pandemic, forecasts U.S. electricity consumption will rise by 0.8% in 2021.

U.S. Renewable Output Up 5%

EIA said output from renewable energy sources was 5% higher year-over-year in the first half of 2020, while gas-fired generation rose by 9% in the lower 48 states, mostly driven by recent, record-high natural gas consumption in late July as much of the country experienced scorching summertime temperatures.

EIA said the decline in coal-fired power generation also is due to a continued grim economic picture for coal-fired power plants. The agency said the average monthly Henry Hub natural-gas spot price was down more than 30% in the first six months of 2020, to $ 1.81 per MMBtu. The agency said that with more than 180 GW of solar and wind plants now operating across the U.S., coal plants are simply “uneconomical in most regions.”

The U.S. has added 18 GW of new combined cycle gas-fired generation capacity since the start of 2018, according to EIA. About 31 GW of coal-fired power has closed during that period, along with 2.4 GW of nuclear capacity. The agency said coal-to-gas switching, which it detailed in a recent report, has been most evident in grids operated by PJM Interconnection and the Midcontinent Independent System Operator. Those are regions in the U.S. Northeast and Midwest where the price competition between natural gas and coal is most significant.

“We need to encourage the efforts of energy stakeholders that have to date invested in coal and natural gas power generation, who are now working to decarbonize these processes, to … accelerate and reinforce their commitment to clean energy goals and gradually erode entirely their use of coal and natural gas in favor of cleaner energy alternatives,” Rami Reshef, CEO of GenCell, an Israel-based fuel cell company, told POWER in a recent interview, echoing the thoughts of many energy industry executives and investors. Several executives, in recent interviews with POWER, noted that renewable energy is gaining investors due to the struggles of the fossil fuel industry.

—Darrell Proctor is associate editor for POWER (@DarrellProctor1, @POWERmagazine).

The post Coal-Fired Generation Down 30% in U.S., 8% Worldwide appeared first on POWER Magazine.