The post EIA Details Impact of Coal-to-Gas Switching appeared first on POWER Magazine.

U.S. utilities have made a significant move away from coal-fired power generation in the past decade, evidenced by a continuing stream of announced coal plant retirements.

That transition has been partly driven by new generation from renewable resources, such as wind and solar power. New data from the Energy Information Administration (EIA) released August 5, though, shows that a large part of that transition came as generators repurposed those coal plants to run on natural gas, or built new gas-fired plants to replace electricity generated by burning coal.

The EIA on Wednesday said 121 U.S. coal-fired power plants were repurposed to burn other fuels between 2011 and 2019. The agency said 85% of those plants were converted to gas, or replaced by natural gas-fired plants. This coal-to-gas switching was driven not only by more stringent emissions regulations, but also by consistently lower prices for natural gas.

Upgrades to gas turbine technology also have played a role, making power plants more efficient and proving more economical for plant operators.

EIA said the trend of coal-to-gas switching continues as coal-fired generation remains challenged by emissions regulations and low prices for natural gas. The agency said it has received notice of at least eight planned natural gas combined cycle (NGCC) power plant projects, with five under construction, that will replace existing coal plants.

“While the easy coal-to-gas conversions have already happened, there is still more room to go,” Adam Rozencwajg, managing partner at Goehring & Rozencwajg Associates, recently told POWER. He said the trend also is occurring globally. “Gas-fired generation’s brightest future remains abroad, particularly in the emerging market world. As a country gets richer, it begins to move away from coal to gas. China wants to grow its gas share of total power dramatically over the next decade in order to try and improve its air quality. India has ambitious targets as well. These will be the largest sources of demand globally.”

Rob McBride, senior director, Strategy and Analytics at Enverus Energy, told POWER that “Absent a scalable breakthrough in battery storage, natural gas will continue to provide significant baseload generation in addition to being called on to fill variable gaps in intermittent wind and solar. The same rationale applies globally, particularly in emerging markets such as China and India. Expect to see continued growth in demand for gas … though most [analysts] agree it may take until 2022 and beyond for demand to catch up with the oversupplied global [gas] market.” [Editor’s note: Read more from McBride in this POWER Interview.]

Retirements and Conversions

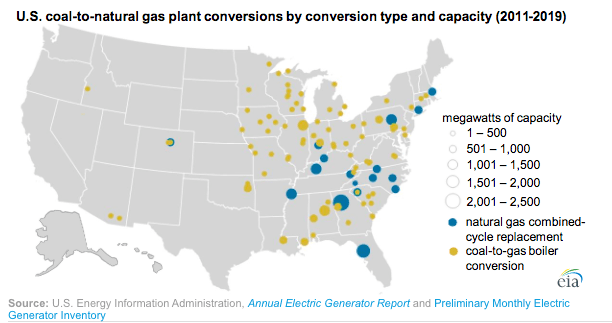

EIA on Wednesday reported that at the end of 2010, 316.8 GW of coal-fired generation capacity was available in the U.S.. By the end of 2019, 49.2 GW of that amount had been retired, 14.3 GW had been converted to natural gas, and 15.3 GW was replaced with NGCC generation.

EIA said, “Two different methods are used to switch coal-fired plants to natural gas. The first method is to retire the coal-fired plant and replace it with a new natural gas-fired combined-cycle (NGCC) plant. The second method is to convert the boiler of a coal-fired steam plant to burn other types of fuel, such as natural gas.” The group said that between 2011 and 2019, the owners of 17 coal-fired plants replaced those plants with new NGCC plants. EIA said those new plants’ 15.3 GW of total generation capacity is 94% more than the 7.9 GW capacity of the coal-fired power plants they replaced. The agency said the “increase in capacity is largely a result of the advanced turbine technology installed in NGCC plants.”

The agency said the remaining plants converted boilers to burn natural gas, though some “were configured to burn petroleum coke [a refinery by-product], waste materials from paper and pulp production, or wood waste solids.”

EIA noted that coal-fired plants in the eastern U.S. accounted for many of the conversions, because of their smaller generation capacity and age—several of the converted plants had been in service for more than 50 years. EIA said 86 plants “converted their boilers to burn natural gas, representing 14.3 GW of capacity.” Some plants did maintain the ability to burn coal, keeping the opportunity to burn whichever fuel was more cost-effective.

Alabama Power, part of Southern Co., converted 10 generators at four coal plants in Alabama from coal to gas during the decade, the most of any power producer in the EIA study. The agency said that conversion of 1.9 GW of capacity occurred in 2015 and 2016, “largely to comply with the Mercury and Air Toxics Standards (MATS) required by the U.S. Environmental Protection Agency.”

The trend of coal-to-gas switching is not limited to U.S. power generation. Farhan Mujib, the senior executive vice president of JGC Corp., and former president of Hydrocarbons Delivery Solutions for KBR, told POWER earlier this year he sees “The next wave of gas-fired combined cycle power plants will be in developing countries like India, Pakistan, Bangladesh and also countries like China switching from coal to gas and in the Middle East switching from oil to gas.”

Stephen Davis, a partner with Akin Gump who specializes in the natural gas industry, told POWER, “I don’t think the natural gas industry is going away anytime soon,” even as he predicts renewable resources will eventually produce more electricity than gas-fired generation. Said Davis: “I have an optimistic view of the future, and of the fossil fuel industry. I think the fossil fuel industry has a great capacity for [helping developing countries]. When you look at the continued realization that burning coal is difficult, you know that there are people who want to move to something cleaner, and that’s natural gas or renewables.”

—Darrell Proctor is associate editor for POWER (@DarrellProctor1, @POWERmagazine).

The post EIA Details Impact of Coal-to-Gas Switching appeared first on POWER Magazine.