The post GE Hitachi: Nuclear Costs, Innovation Must Be a Pivotal Focus for Carbon-Free Future appeared first on POWER Magazine.

Nuclear energy’s future as a critical pillar in a decarbonized world will depend on its adaptability to rapid change, but the sector must focus on costs, certainty of outcome, reliability, and experience to cement its role beyond the transition, GE Hitachi Nuclear Energy (GEH) President and CEO Jay Wileman told POWER in an exclusive interview.

While the world’s existing nuclear fleet of more than 400 GW already plays an important energy security role—providing affordable and stable power that is largely independent of fuel market price fluctuations—an expansion will be necessary to bolster climate-conscious energy goals. But the challenge is multi-faceted, Wileman said.

First, it will require keeping online the world’s installed base of 450 reactors, both by maximizing their lifetime output and diversifying their commercial applications beyond power generation. “If you lost that installed base, you’re setting yourselves decades backward in your path toward getting to the carbon goals,” he said.

A second pathway is to build out new nuclear with “best-in-class” technology, focusing on technology innovation that could reduce construction costs and schedule as well as ensure operational reliability and safety. “Historically, nuclear has been looked at as very costly, characterized by long project durations and uncertainty,” Wileman said.

But as a parallel pathway, governments should also fund research, development, and demonstration projects to encourage early adoption of small modular reactors (SMRs) and advanced reactors, he suggested. The private sector, too, has a role in developing innovations to reduce cost and complexity, pushing to drive down investment costs per MW, he said.

Urgent Action Is Necessary

Wileman spoke to POWER in June, following a recent ramp-up in calls on the world stage for urgent actions to address climate change. In May, during the Leaders Summit on Climate Change, policymakers warned economies around the world have less than 30 years to cut overall carbon emissions to net-zero. In a landmark “roadmap” issued on May 17, the International Energy Agency (IEA) highlighted nuclear’s pivotal role in future carbon-free systems, suggesting installed nuclear power should increase by 40% by 2030—requiring new nuclear capacity additions of up to 30 GW—and double by 2050. Earlier this month, the Group of Seven (G7) leaders committed to an acceleration away from unabated coal capacity and more progress on electrification; batteries; hydrogen; carbon capture, usage, and storage; and “for those countries that opt to use it,” nuclear power.

Still, unclear messaging regarding support for nuclear’s future role has prompted some alarm. In May, setting out a policy platform ahead of the United Nations Climate Change Conference of the Parties (COP 26), which will be held in Glasgow, Scotland, Oct. 31–Nov. 12, the world’s nuclear industry associations starkly warned in a joint statement that the retirement of nuclear plants without new investment would represent “the single greatest loss of clean power in world history.” Without new projects, “more than 100 GW of nuclear capacity will retire globally within 20 years,” they said.

Wileman, who heads GEH, a 2007-established alliance between technology conglomerates GE and Hitachi, noted both GE and Hitachi are spearheading climate leadership initiatives. GE, which in December rolled out an all-in commitment to fight climate change, in June notably issued a position paper that highlights a concerted role for its Steam Power business to bolster nuclear.

As Frédéric Wiscart, senior executive of Projects at GE Steam Power, told POWER, GE’s steam turbine technology already operates in 50% of the world’s nuclear power plants, producing 200 GW for the global grid. The business group, which in September announced it would exit the new-build coal power market, is “clearly seeing a change in mindset in the developers, customers, and governments” that is supportive of a build-out of nuclear’s role in the climate equation, he said.

Wilmington, N.C.–based GEH, a company whose core business today comprises fuel technology and nuclear services, is meanwhile seeing an upsurge in interest in its SMR and advanced nuclear offerings, Wileman said. The company has developed the BWRX-300 SMR, which GEH projects can be deployed by as early as 2028, but it is also part of a core team, along with TerraPower, that is spearheading the demonstration of the Natrium design, likely in Wyoming, within the next seven years under the U.S. Department of Energy’s (DOE’s) Advanced Reactor Demonstration Program.

Big Prospects for the BWRX-300

GEH’s prospects to demonstrate the BWRX-300 SMR, notably, were buoyed when Ontario Power Generation (OPG) last year resumed planning activities to build an SMR as early as 2028 at its Darlington Nuclear Station in Clarington, Ontario—Canada’s only site that holds a preparation license for future new nuclear development, with a completed and accepted Environmental Assessment. An indicative schedule assumes that the Canadian Nuclear Safety Commission will issue a license to build by 2024, and a license to operate by 2027.

In October, OPG kicked off advanced engineering and design work for that project by choosing three SMR developers: GEH, Terrestrial Energy, and X-energy. While OPG recently said it hasn’t yet “absolutely decided it’s going to be one of those three,” it anticipates picking a vendor at the end of this year.

“We fit that bill very well,” Wileman told POWER. “I think we have to demonstrate to OPG what we bring—not just the best technology, but certainty. We bring all our experience. We bring our partnership—because as you build these, they are 60-, 80-, 100-year partnerships with your customers.” And while GEH also already has a presence and can “localize” in Canada, it has made an economic case that suggests its first SMR could create a gross domestic product impact of more than CA$ 1 billion in Ontario during the manufacturing and construction phase.

At the same time, GEH is spearheading potential deployment applications for the BWRX-300 in Poland, notably with Synthos SA, a manufacturer of synthetic rubber and one of the country’s biggest producers of chemical raw materials. “We’re talking with Estonia, the Czech Republic, the UK, and Japan, obviously, keeping an eye on things with our partner Hitachi,” he said. “So there’s global interest, but I think that the near-term is Canada and the U.S.”

As Wileman explained, a crucial selling point for the BWRX-300 is that it strives to reduce construction costs and schedules. SMR and steam turbine designs can be built and assembled in a factory with improved construction methods, and shipped to site as a module, driving down investment cost per MW, he said.

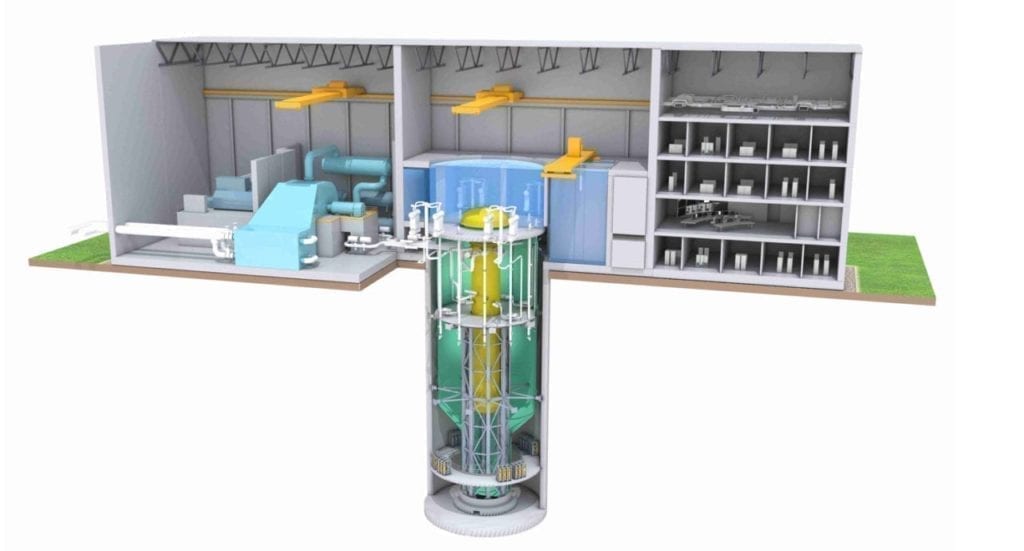

GEH estimates the BWRX-300 SMR design also results in about a 90% volume reduction in plant layout as compared to GEH’s large-scale Economic Simplified Boiling Water Reactor (ESBWR) design (from which the BWRX-300 is derived), as well as an estimated 50% less construction material per MW as compared to large reactors. “Other opportunities for construction cost and schedule optimization include shaft construction techniques from the tunneling industry and use of second-generation steel-concrete composite modules,” it says. Meanwhile, its ESBWR technology roots and integral isolation valve design simplify licensing, allowing the design to meet key regulatory milestones sooner. The SMR design also uses an existing fuel design manufactured by Global Nuclear Fuel (GNF), a GE-led joint venture with Hitachi, and it benefits from a proven component and supply chain risk, said Wileman.

“Our target is to be under $ 3,000/kW and a capital cost of around $ 1 billion dollars—and that’s a lot more workable on some of our customers’ balance sheets than some of the builds that are going on here in the U.S. today,” he said. All of that positions the BWRX-300 to become the “lowest-risk, most cost-competitive and quickest to market SMR,” he said.

New Avenues for Nuclear

Wileman noted much work is underway to re-imagine nuclear power as not only dispatchable electricity, but also thermal energy and chemical production, essentially diversifying its output. The critical aspect that will underscore nuclear’s future success is its capability to provide value beyond baseload power generation, he noted. Flexibility, a core issue, is being tackled through molten salt storage in the Natrium design, for example, he said.

“Hydrogen production will be key. I can see a BWRX-300 syncing up very well, feeding the front-end of a GE combined cycle gas turbine that’s running on hydrogen,” he said. “I can see us in Poland or in the Scandinavian area doing industrial heat.”

Some key technical aspects will still need to be ironed out, however, as Wiscart noted. “The turbines for the SMRs are closer to the ones that we know for smaller coal-fired power plants. But we still need to develop this turbine specifically for the SMR in terms of materials because the steam pressure and steam temperature conditions will not be the same as a coal-fired unit’s,” he said. “Technological developments are underway, and we are working on them to be ready for the Canadian project, for example.”

For now, GE Steam Power expects that opportunities in the large-scale nuclear plant market will continue to flourish. GE’s new position paper forecasts a notably optimistic yearly demand of 10 GW for new nuclear plants over the coming decade.

Wiscart said these plants may replace aging nuclear generation. In the UK—where all currently operating nuclear plants (except Sizewell B) are slated to retire by 2030—construction of the 3.2-GW Hinkley Point C project is underway, while 3.2-GW Sizewell C is under development. And in France, EDF is exploring replacing older units of early generation technology with three pairs of “modern, more powerful” EPR2 reactors, he said. However, major projects are also under consideration by nuclear “newcomers” like Poland, which is looking to move away from coal, and Saudi Arabia, which has suggested it could build up to 17 GW by 2040, he said.

One emerging approach to reduce development costs associated with large-scale new builds is “to establish and consistently use repeatable designs,” Wiscart suggested. “Akkuyu, Turkey’s first nuclear power plant, includes four identical units featuring GE’s Arabelle steam turbine,” he said. Increasing a unit’s efficiency and reliability are also crucial, he said. “Today, the world’s most powerful steam turbine [an Arabelle turbine] is operating at China’s Taishan Nuclear Power Station, generating 1,750 MW of power output per unit,” he said. But Hinkley Point C “is expected to break this record; the steam turbines for those units are fitted with a 75-inch last stage blade, generating an additional 20 MWs per unit.”

Potential Gains for Existing Nuclear

For now, at least, technology innovations already exist to boost the efficiency and output of the existing fleet, as both Wileman and Wiscart suggested. In the existing fleet, that could involve reactor upgrades through steam turbine retrofits, which could result in increased steam flows, and therefore, increased power output. Wiscart said increasing the thermal power rating and retrofitting a typical steam turbine and generator can achieve up to 20% or more additional gross power output.

Since the early 1990s, a thermal power uprate campaign for GE boiling water reactors “has resulted in additional power generation equivalent to three new 1,500 MWe nuclear power plants,” he noted. Even simply retrofitting a typical steam turbine shaft line with no reactor flow changes can achieve an additional 2.5% to 4% gross power output and lengthen the time between major turbine maintenance outages to 6, 8, or 12 years, he suggested. These improvements could be especially financially fruitful for reactor owners seeking to extend operational licenses up to 80 years.

On the fuels front, fuel cycle economics are also constantly improving. GNF, which is exploring accident tolerant fuel (ATF) under a DOE program, is making headway in testing its new IronClad and ARMOR technologies. In December, notably, Oak Ridge National Laboratory received the first GNF-developed nuclear fuel test rods, which spent 24 months at Southern Co.’s Edwin Hatch nuclear plant. GNF is also pursuing higher uranium enrichment to reduce fuel load requirements, decrease spent fuel volumes, and extend refueling intervals to 30–36 months, said Wileman.

Digitalization’s Significant Reach

But perhaps the biggest boosts nuclear received from developments over the past decade have been from digitalization. Wiscart noted that nuclear utilities, which are grappling with pressure to reduce operations and maintenance (O&M) costs to stay competitive, now have access to asset performance management solutions, predictive analytics, and O&M process automation. Wileman, meanwhile, pointed to Outage Planning and Analytics (OPA) software, which GEH developed in collaboration with GE Digital to streamline the entire nuclear refueling outage process, including planning, scheduling, and execution.

Digitalization is substantially tamping down costs for SMRs, too, Wileman said. GEH has so far created a digital twin for the BWRX-300 under the DOE’s Advanced Research Projects Agency-Energy Generating Electricity Managed by Intelligent Nuclear Assets (GEMINA) program, which is targeting a ten-fold reduction in O&M costs. The Massachusetts Institute of Technology is also currently under contract to assemble, validate, and exercise high-fidelity digital twins of the BWRX-300 systems, he said.

“If you think about what the [Nuclear Regulatory Commission] is trying to achieve in its probabilistic risk assessment of these designs, you can do a lot of great work in demonstrating your safety case with that digital twin, so that really helps you inform your design as you go along,” Wileman said. “The other piece is instrumentation and controls. Plants have systems that have sensors, so there’s just a lot of efficiencies that can be done there as well.”

Despite these improvements, much more will be required to embrace the significant role of existing and future nuclear plants in the energy mix, Wileman said. A key aspect is “making sure we have everybody at the table, understanding the value of nuclear in this carbon environment.” That will require discussions about “what nuclear really is, not just in the carbon case, but in the safety case, in the jobs case, in its [economic] impact,” and its value in high learning, he said.

—Sonal Patel is a POWER senior associate editor (@sonalcpatel, @POWERmagazine).

The post GE Hitachi: Nuclear Costs, Innovation Must Be a Pivotal Focus for Carbon-Free Future appeared first on POWER Magazine.