The U.S. is investing heavily to ensure its future coal-fired power fleet will be cleaner, more efficient, and more flexible, experts said at the 9th International Conference on Clean Coal Technologies in Houston on June 4.

The conference—which is taking place this week in the U.S. for the first time—is spearheaded by the IEA Clean Coal Centre (IEA CCC), an autonomous collaborative partnership organized under the International Energy Agency (IEA), and co-hosted by the U.S. Department of Energy (DOE). The U.S. Energy Association (USEA), which represents 150 members across the U.S. energy sector, is also backing the conference. As Andrew Minchener, general manager of the IEA CCC, noted, the conference and workshop are modes of “knowledge transfer and capacity building,” but the event also serves as a “clear and impartial dialogue on the relative merits on coal technologies.”

For the most part, discussions at the conference about the future of coal were framed by the drastic changes affecting the energy sector, including concerted decarbonization efforts bolstered by the Paris Agreement, that threaten to diminish coal’s share in global energy demand. According to the IEA’s World Energy Outlook 2018, if ambitions expressed by the world’s policymakers to boost energy efficiency, ramp up renewable resources, and slash air pollution are adopted, global coal demand, which constituted 27% of total energy demand in 2017, could decline to 22% by 2040.

Coal Under Pressure in U.S., but Hope Exists

In the U.S., where coal continues to play a critical role in assuring reliability, fossil energy will need to be a part of the solution on greenhouse gas (GHG) emissions, said Lou Hrkman, the DOE’s deputy assistant secretary for the Clean Coal and Carbon Management office, on Tuesday.

Last year, he noted, 20 coal plants—a total of 14 GW—were retired. Yet, “even with the electricity market distortions caused by tax incentives, mandates required by states, the old war on coal—which has finally ended—and the low cost of natural gas, today coal still provides about 30% of the nation’s power generation. By 2040, it will supply nearly 20% of the power generation in the U.S.—as much as wind and solar combined,” he said.

But far from rendering coal obsolete, changes in the power sector create opportunities for advanced coal-fired generation, for both domestic and international deployment, Hrkman argued. However, it will require that generators transform how existing assets are operated and maintained. “The need for considerable dispatchable generation, critical ancillary services, and grid reliability creates opportunity for advanced coal-fired generation,” he said, also noting: “Fundamental changes to the operational and economic environment are expected into the next decade and beyond.”

Critically, Hrkman said, to remain economic in existing markets, today’s baseload coal plants will need to ramp up flexibility to follow load. The existing fleet also lags behind the world in efficiency, he suggested, noting, “State of the art in coal power generation is high-efficiency, low-emission [HELE] technologies.”

Improving Plant Efficiency and Capturing Carbon

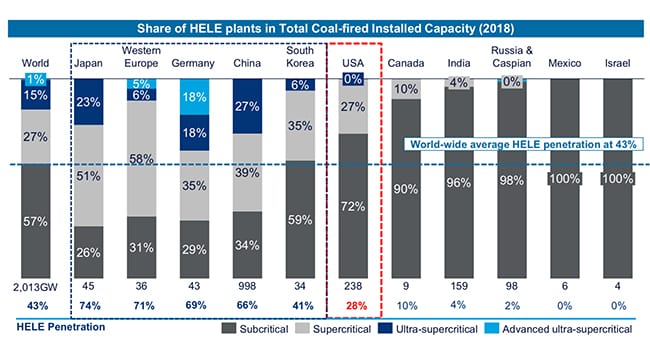

As Wood Mackenzie reported in January 2019, HELE plants currently represent 43% of global coal-fired power plant capacity: 27% of the fleet is supercritical—operating at a steam temperature of between 550C and 600C, with an efficiency of up to 42%; 15% are ultrasupercritical (USC), which means they operate at steam temperatures beyond 600C and have efficiencies of up to 45%; and below 1% are considered advanced USC (AUSC), having efficiencies of more than 45% and operating at steam temperatures of 700C.

Share of high efficiency low emission plants in total coal-fired installed capacity (2018). Source: Wood Mackenzie

By comparison, 72% of the U.S. coal fleet is subcritical, which means their efficiencies reach only up to 38%; 27% of the fleet is supercritical; and the nation has only one USC plant: American Electric Power’s 2012-opened 614-MW John W. Turk Jr. plant in Arkansas (POWER’s Plant of the Year in 2013). Wood Mackenzie claims, however, that Longview Power, a 2011-opened West Virginia coal plant, is the nation’s most-efficient coal plant.

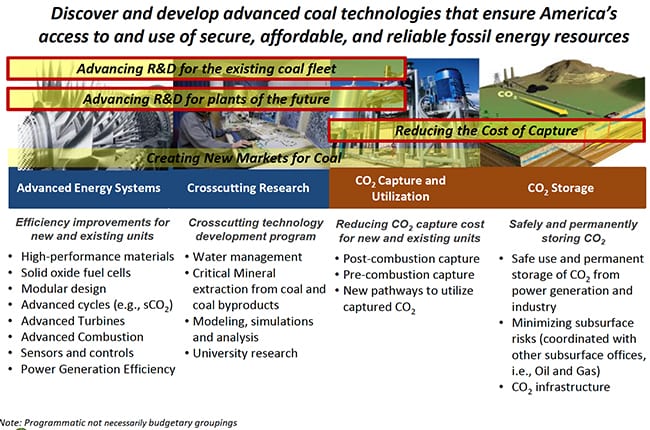

“We need to accelerate bringing our best ideas to commercial availability as quickly as possible. That is exactly what we are doing at DOE,” Hrkman said. The DOE’s current research and development (R&D) programs are primarily focused on three key areas: advanced energy systems; crosscutting research; and carbon capture utilization and storage (CCUS). Its key goals are to improve efficiency for new and existing units, reduce the cost of carbon capture, and ultimately, create new markets for coal, Hrkman said.

The U.S. Department of Energy’s Office of Fossil Energy is seeking to revitalize coal through an assortment of initiatives. Source: DOE

Despite President Trump’s denial of climate change (in a June 3 interview with Piers Morgan that aired on Good Morning Britain, Trump said, “I believe that there’s a change in weather, and I think it changes both ways”), the DOE continues investing billions in CCUS. On Tuesday, Hrkman said: “The payoff for those investments, carbon-free fossil energy, is just over the horizon. Soon, it will be a technology option for regulators and companies to consider in their energy plans.”

Driving lower costs for CCUS, he noted, is one of the DOE’s “highest priorities.” Today, it costs about $ 50 to capture a metric ton of CO2 from the flue gas of a typical coal-fired power plant. “This level of cost limits wide adoption of the technology without various support mechanisms,” Hrkman said. “Our goal is to reduce CO2 capture costs to $ 30/ton by 2030.”

Small Modular Coal Plants

The DOE is also convinced that next-generation coal plants in the U.S. will be “small-scale, modular coal plants,” Hrkman said. That effort, which the DOE calls the “Coal FIRST (Flexible, Innovative, Resilient, Small, Transformative)” program, will prepare coal for a distributed generation future. “We don’t see the future here in the U.S. the need to construct 1,500- to 2,000-MW power plants as we have in the past. We also see the potential in developing nations for this smaller modular-type of technology, especially in Africa and Asia, where they do have a desire for smaller, more economical options,” he said. The future coal fleet, he added, will need to compete with other sources of power generation, including natural gas. “A smaller footprint means less complexity, easier permitting, and lower construction costs,” he said.

Future coal plants will likely range from 50 MW to 350 MW, and likely have near-zero emissions of carbon, because carbon capture will be integrated. They will also be “nimble and flexible, to meet the demands of an evolving grid, with the ability to ramp up and down as demand dictates,” Hrkman said. And finally, they will be “highly efficient—north of 40%, which will make carbon capture easier and less expensive.”

Hrkman, however, acknowledged that coal’s future hinges on continued investment. “In recent years, as political opposition to coal-related investment and lending intensify in many parts of the world, public finance for greenfield coal power projects is increasingly scrutinized, and in some cases, virtually forbidden.” But targeting coal companies and power companies, which is supposedly based on “ethical” recommendations, is ironic, he noted.

“Are they trying to eliminate competition or do they really feel their actions are ‘ethical’?” he asked.

Bringing New A-USC Technology to Market

Still, despite the glaring lack of appetite for new coal in the U.S., R&D efforts, specifically to increase coal plant efficiencies, are yielding results, as Horst Hack, a researcher at the Electric Power Research Institute (EPRI) said on Tuesday.

EPRI, a nonprofit dedicated to advancing power sector efforts on various fronts, is spearheading the “ComTest Project,” with the DOE, which seeks to boost and demonstrate coal plant component efficiencies by 25% beyond that of average existing U.S. coal plants—which currently stands at 33%—and ultimately minimize risks for utilities that want to build A-USC plants.

ComTest, which is currently scheduled for completion by September 2021, is currently executing the second phase, and it could be followed by a full-plant demonstration after 2025. Phase 2 involves advancing manufacturing efforts to complete a U.S.-based supply chain for full, commercial-scale (800-MW to 850-MW) A-USC components made of nickel-based alloys that could allow for operations at 760C. So far, since being awarded funding by the DOE in December 2018, the project team has ordered materials for the superheater/reheater assembly, and executed key subcontracts with Riley Power—a manufacturing arm of Babcock Power—General Electric (GE), and EPRI.

However, a critical issue that could impede rapid uptake of A-USC technology involves costs, Horst noted. Costs of the raw materials—including for the superalloys needed—are variable, he said, though he noted the application won’t need as much of the material because “it’s so much stronger and considerably thinner.” EPRI’s research in Phase 2 promises to reveal more about schedule and cost implications for the raw materials needed as well as for fabrication.

“The main vendors who may be in a position to make this and the customers who may be in the position to buy this don’t have much in the way of certainty about what these materials will ultimately cost,” Horst said.

When asked whether the U.S. power market—which has abandoned all efforts to build new coal plants and shows a marked preference for cheap natural gas—would be ready to take on A-USC as an alternative to conventional coal technology, Horst responded that existing coal assets offer potential. “There is interest in being able to maintain the usefulness and the life of these existing coal-fired assets,” he said.

DOE efforts to develop A-USC technology began in 2001, when the market for new coal was still ripe, but, owing to market conditions, it has since shifted away from an exclusive focus on greenfield projects. “There’s greater understanding of how these materials could be used in A-USC retrofits in existing plants or be able to use these materials at existing plants, even at lower temperatures, not necessarily A-USC, but to retrofit those in such a way that they could be more flexible,” Horst said.

“Anything that we can do to the existing coal-fired fleet to help improve that response time would help. Being able to use stronger materials and would be able to reduce the thickness of critical components would be a good step in that direction.” The research could also yield key insights on advanced materials that could help development of supercritical CO2 cycles, concentrated solar, and nuclear power, he noted.

—Sonal Patel is a POWER associate editor (@sonalcpatel, @POWERmagazine)

The post How the U.S. Is Investing in Advanced Coal Technologies appeared first on POWER Magazine.