Crunch | British company Reaction Engines had promised world’s first space plane

https://www.ft.com/content/4dc0145b-c6c3-423d-a22b-2b7f73e1b6a7 Hydrogen Aviation

Energy Central…

Your Source for Energy Jobs & Industry News

https://www.ft.com/content/4dc0145b-c6c3-423d-a22b-2b7f73e1b6a7 Hydrogen Aviation

Energy Central…

Understandably this is a distressing event and one that can be emotional. It is important to think practically and work through the details.

Layoffs are a business decision and not an unusual event. However, it may be for you, and you most likely have questions. It is normal to feel stressed, so take some time to process the information and what it means for you. Check in on colleagues, and don’t feel you need to take immediate action. Take a moment to process the information.

In particular, understand the reason for the layoffs and determine the likelihood of impact on your role. These decisions are usually made due to financial or structural decisions. Consider how many people might be impacted. Note the timeline of events so you can do your best to plan accordingly if you are laid off. Consider if the company will provide additional support to former employees and if there are options to start to look for other work in preparation.…

American Electric Power’s (AEP’s) long-serving chairman, president, and CEO, Nick Akins, will step down as CEO on Jan. 1, 2023, and has already passed the company’s presidency to Julie A. Sloat, AEP executive vice president, and chief financial officer (CFO).

Sloat, 53, will become the power generating company’s CEO in January, making her the first woman to serve at the helm of the giant power generating company and only the seventh CEO in its 116-year history.

Sloat’s election as CEO by the AEP Board of Directors on Aug. 10 marks a notable executive shuffle for the public utility holding company, which is in the midst of a historic transformation into a more agile and customer-focused provider of energy solutions. As CEO, Sloat will be expected to navigate the massive company through the energy transition, which is being driven by multiple, and often conflicting factors, including changing customer needs, evolving policies, stakeholder demands, demographics, competitive offerings, technologies, and commodity prices.…

Landsvirkjun, the national power company of Iceland, on June 28 announced it intends to capture and reinject carbon dioxide (CO2) from Þeistareykir (Theistareykir) Geothermal Station, and at the same time reduce CO2 emissions from Krafla Power Station through enhanced well management efforts at that site. Construction of the project, called Koldís, is expected to begin next year, and the project should be fully operational by 2025.

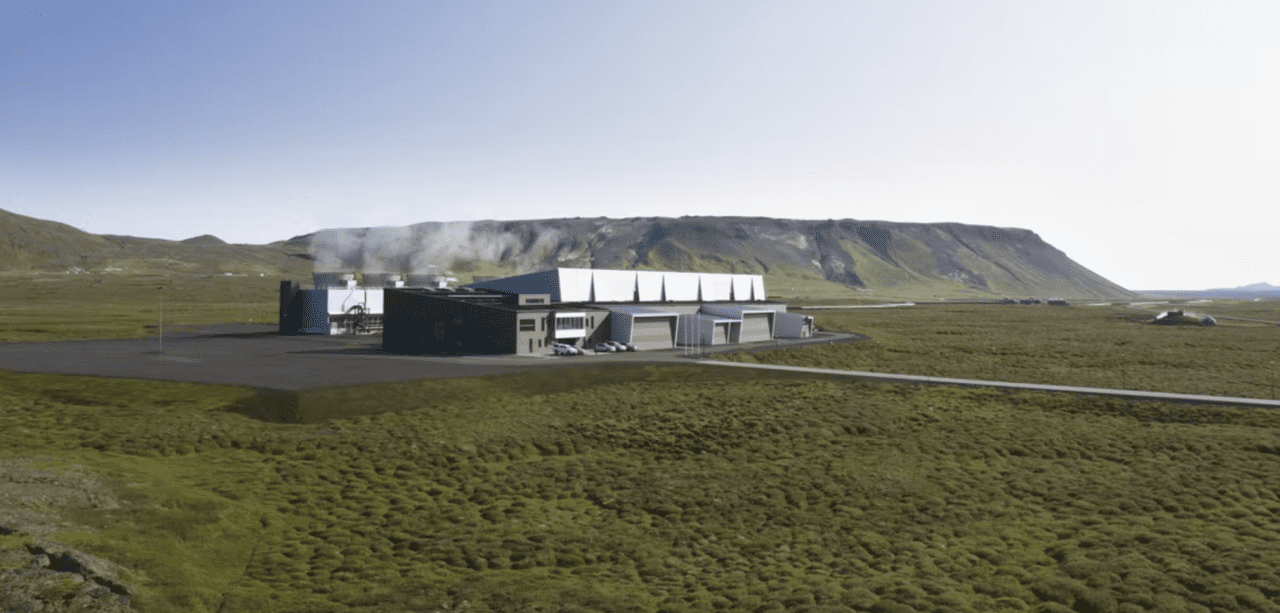

Landsvirkjun wants its operations to be carbon neutral in 2025, and already has progressed toward that goal, reducing the group’s carbon footprint by 61% since 2008. A major part of its strategy is to significantly reduce emissions from geothermal power generation, as the vast majority of the company’s greenhouse gas emissions are generated by geothermal energy. Landsvirkjun expects the Koldís project will capture almost all CO2 and hydrogen sulfide from the two-unit, 90-MW Theistareykir power station (Figure 1), and return it to the ground for storage, from 2025 onward.

Energy Transfer, a major pipeline firm that threatened to terminate natural gas service to five Vistra Corp. gas-fired power plants in Texas next week as part of a $ 21.3 million penalty payment standoff, has relaxed its ultimatum, though the underlying dispute continues.

In a letter filed with the Texas Railroad Commission late on Jan. 20, the midstream and intrastate transportation and storage giant said it reached an agreement with Vistra subsidiaries Luminant Energy Co. and Dynegy Marketing to “temporarily maintain natural gas service” through March 31, 2022, not Jan. 23, as it had threatened.

However, Energy Transfer subsidiaries Energy Transfer Fuel (ETF) and Oasis Pipeline will continue to sell natural gas to the Vistra subsidiaries under terms and conditions that have been place since Dec. 1, 2021. It will mean that Luminant will keep buying natural gas for power generation at daily spot prices.

Luminant in a complaint filed with the Railroad Commission—Texas’s oil and gas regulator—on Jan.…

The post Gas Exploration and Production Company to Buy Gas-Fired Power Plant in Texas appeared first on POWER Magazine.

BKV Corp., a privately held natural gas exploration and production company headquartered in Denver, Colorado, said it will purchase the Temple 1 power plant in Temple, Texas. The deal, valued at $ 430 million and subject to customary closing conditions, is expected to close in the fourth quarter of 2021.

“We’re excited about this acquisition, and the strategic steps we are taking to position BKV as a leading integrated energy company with cleaner, greener energy,” Chris Kalnin, CEO of BKV, said in a statement issued to POWER. “By extending our natural gas business into a power business we are able to deliver to unprecedented grid reliability, while also creating industry leading ESG [environmental, social, and governance] standards because we can directly certify our emissions footprint at each step in the value chain, from underground molecule to burner tip.”

Temple 1 (Figure 1) is a 758-MW combined cycle facility built in 2014.…