On Heels of $2.3B Financial Close, Vineyard Wind Joint Venture Partners Announce Restructuring

The post On Heels of $ 2.3B Financial Close, Vineyard Wind Joint Venture Partners Announce Restructuring appeared first on POWER Magazine.

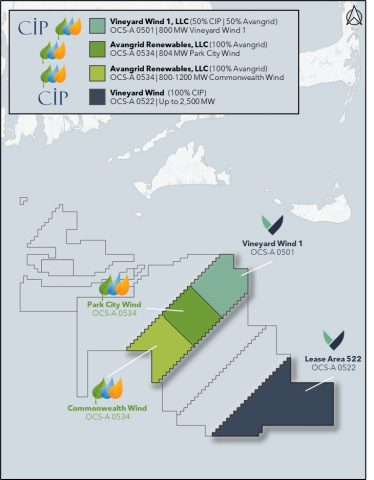

Partners developing the 800-MW Vineyard Wind 1 offshore wind farm have announced they will swap assets jointly owned by their 50/50 Vineyard Wind joint venture to allow each party to focus on its separate expansion within the burgeoning U.S. offshore wind industry once the 800-MW Vineyard Wind 1 offshore wind farm is operational.

The Vineyard Wind joint venture is equally held by Connecticut-based AVANGRID subsidiary Avangrid Renewables—a company whose majority (81.5%) shareholder is Spanish renewables giant Iberdrola—and Danish fund management company Copenhagen Infrastructure Partners (CIP). Restructuring will enable both companies “to leverage their strengths and expertise to continue to grow the U.S. offshore wind industry” and “better align project timelines with their separate strategic objectives,” the partners said on Sept. 21.

The development is noteworthy given that the partners recently raised $ 2.3 billion of senior debt to finance the construction of the Vineyard Wind 1 project.…