Markets may currently favor natural gas, but coal, which has been diminished for “good reason,” will likely have a significant place as a reliable fuel for power generation, a diverse panel of U.S. coal experts—including a generator, a supplier, and a market analyst—suggested at CERAWeek by IHS Markit in Houston on March 7.

Coal lost its dominant role in the U.S. generation mix in 2016 and fell further to a 30.1% share at the end of 2017, drastically lower than the 48.5% it held in 2007. According to the Energy Information Administration (EIA), natural gas’s share surged to 31.7% in 2017, a leap compared to its 21.6% share in 2007.

A panel at CERAWeek by IHS Markit on March 7, 2018, discussed the role of coal and gas in American power. From left to right: Jim Thompson, IHS Markit; Paul Bailey, ACCCE; David Ownens, TVA; David Khani, CONSOL Energy; and Samuel Andrus, IHS Markit. Source: POWER

According to Paul Bailey, president and CEO of the American Coalition of Clean Coal Electricity (ACCCE)—an organization that represents the nation’s coal generation fleet, not the coal industry, as is commonly assumed, he noted—the decline is rooted in the mass retirements of coal plants.

Nearly 600 coal units have been retired since 2010. The retired units were 59 years old on average and relatively small—about 140 MW in size. “Right now, about a third of the coal fleet is either retired or will retire in the next few years,” Bailey said. However, he pointed out, the units that remain online are about 41 years old and about 340 MW on average. “One thing that suggests is that the units that have retired may have retired for good reason. But there’s still a large coal fleet out there,” he said.

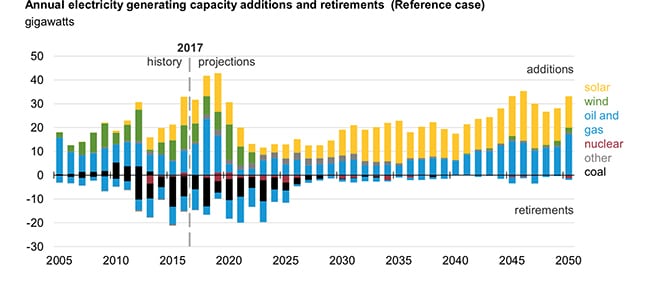

The U.S. power mix has changed dramatically over the past decade, reflected in shifting capacity additions and retirements. Source: EIA, Annual Energy Outlook 2018

Retirements have accelerated in recent years owing to a number of factors, Bailey noted. “EPA [Environmental Protection Agency (EPA)] policies have been a huge problem for the last eight years,” he said. Yet, while EPA Administrator Scott Pruitt has moved to rescind or replace some of those policies, the ACCCE hasn’t asked the EPA to “do away” with anything except the Clean Power Plan. Retirements were also spurred by renewable subsidies, electricity market rules, and cheap gas.

But for Bailey, low gas prices evolved under market forces—and that’s a good thing. “We’re very comfortable competing against gas. Gas has a role, coal has a role,” he said. “I’m not going to sit here and tell you that gas is better than coal, or coal is better than gas, or renewables are better. We are for fuel diversity.”

He added, however, that the future of the nation’s coal fleet hinges on how well it is valued for its fuel security and grid resilience attributes, noting that the Department of Energy’s (DOE’s) proposed grid resiliency rule , and the Federal Energy Regulatory Commission’s (FERC’s) subsequent action to examine the resilience of the bulk power system could be a “game changer.” The ACCCE believes that the coal fleet is “undervalued right now,” and it is backing price reforms. That could take “two, three, five years, and then at the end of that period of time—whatever it is—we’ll just see what happens,” he said.

The Economic Argument

Bailey noted that the ACCCE backed the grid proposal along with the nuclear industry, but the measure didn’t have the backing of many major power companies, who have driven the rapid coal-to-gas transition primarily out of cost considerations.

Plant retirements through 2047 vary by state. In Texas, a significant amount of coal capacity is slated for retirement. California will retire its Diablo Canyon nuclear plant along with a number of older steam gas plants. Source: EIA

David Owens, who has been vice president of coal and gas services for the Tennessee Valley Authority (TVA) for about six years, said that as recently as 2007, the federally owned company burned about 45 million tons of coal a year “pretty much like clockwork,” and very little gas. But today, it consumes 15 million to 20 million tons of coal and has hiked its gas burn to 300 billion cubic feet per year. Coal’s share in the company’s portfolio has plunged dramatically from 55% in 2007 and will keep falling to about 20% in coming years, he said.

“I’m sort of agnostic to what fuel we use,” Owens noted. “My goal is to try and provide reliable, economic power to the best of our ability. If that is coal, then we’ll burn coal, and if it’s gas, then we’ll burn gas,” he said. That considered, the TVA also strives to have a balanced portfolio, and it is constantly evaluating “how much is too much gas?” he said.

Echoing Owens’ sentiments, David Khani, executive vice president and chief financial officer for CONSOL Energy, also opined that business economics is what really drives its underlying value. But for Khani, who began his career as an analyst, the approach was different.

Competition between coal and gas has been apparent since 2002, he said, and its evolution has been expected. That’s why CONSOL—which began operations as a purely coal company 151 years ago and only developed a mammoth natural gas arm as a means to sell gas from coal mines in the 1980s—in November 2017 cleaved its gas and coal business into two independent publicly traded companies. Its natural gas business was renamed CNX Resources Corp., and its coal business remains CONSOL Energy. “Having [sat] on both sides of the business, I have a new perspective of what it really takes to run both sides,” he said.

On the coal side, CONSOL has a hold on a business that generates a free cash flow. “If you think about the [natural gas exploration and production (E&P)] business, it’s a treadmill effect,” Khani explained. “If you have very sharp declines, you’ve got to keep drilling and keep the production growing. On the coal side, [you] really spend a lot of capital up front and then your mine is run for the life of the mine, and our mines run for 26 years flat. We can run maintenance capital with zero decline for 26 years. So [it’s a] very different profile—risk profile—than an E&P company.”

At the moment, a lot of oil and gas companies are dramatically underperforming both in the energy space and other sectors, Khani pointed out. “[The industry’s] access to capital is slowly going away, and it’s because there’s overproduction. The return isn’t fully adequately justifying the capital that’s being spent,” he said.

For CONSOL, however, the move to integrate natural gas into its operations was a good one for business, Khani explained. A lot of coal companies went bankrupt in part because they bought metallurgical assets at the peak of the cycle and financed it in many ways. “It was just the wrong thing to do for the money that has no duration behind it.”

Dealing with Volatility

Meanwhile, power generators who consume less coal owing to increased generation from other resources aren’t immune to volatility. As panel moderator Jim Thompson, senior director of coal and energy at IHS Markit, pointed out, many utilities have adopted shorter-term coal contracts and bigger spot purchases because “coal burn can be volatile from not only year to year, but season to season.”

Owens noted that the TVA has entered into three-year contracts to avert risks of running short, and the company is constantly balancing its needs. “There’s been years where up in one month, I’ve been long with the rest of the year, you know 5 million tons of coal—that’s a lot of coal—and then you turn around, three months later, you’re flat,” he said. “We do have the benefit that we have terminals and we can put coal on the ground in terminals, especially [Powder River Basin coal].” Terminals were particularly important during the recent cold snap, he said.

Despite supply hitches, coal plants were inherently pivotal in keeping the lights on during the winter, the panelists generally noted. ACCCE’s Bailey said that was in spite of the fleet being short of the DOE’s proposed definition of “fuel security,” which requires generators to have a 90-day supply of fuel onsite. “We didn’t give [the DOE] that number,” he said. “The coal fleet averages 70 to 80 days of coal supply onsite.” He added that the ACCCE is uncertain how FERC’s review of regional resiliency will turn out; however, it will keep pushing for fair valuation of coal’s fuel security attribute.

From a supply perspective, premature retirements don’t necessarily affect business, “because we picked the right power plants,” Khani said. Valuing fuel attributes may offer benefits in the PJM Interconnection, but other than that, requiring coal plants to have a 90-day supply “just gives them more negotiating power over price,” he added.

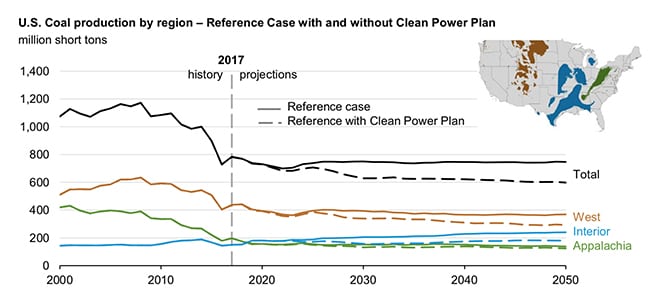

The Energy Information Administration in February projected that coal production will decrease through 2022 owing to retirements of coal-fired electric capacity. Demand from the power sector is expected to remain flat through 2050. Source: EIA, Annual Energy Outlook 2018

The panelists also agreed, however, that gas plants played as significant a role during the cold snap, as long as they were positioned well on the gas grid. Samuel Andrus, senior director of energy at IHS Markit pointed out that disruptions in coal transportation by rail could be worrisome in the same way inadequate gas infrastructure could cause shortages. But gas supply itself wasn’t at issue: The outlook for gas production from Appalachia, Pennsylvania, West Virginia, the Marcellus, and the Utica “is just a massive, massive resource base,” he noted. Production from Appalachia alone “could serve the entire U.S. for what, 15 years, even if you took nothing from anywhere else—it’s very big,” he said.

Bailey offered a rebuttal. “I promise you … there is no fuel war,” he began. “We’ve said compare and contrast is not warfare.” However, he noted, the ACCCE has issued cautions about over-reliance on natural gas. “There are 270,000 MW—and this is according to [the North American Electric Reliability Corp.]—of natural gas combined cycle without dual-fuel capability in this country.” Without a backup fuel source (either fuel oil or diesel) stored onsite, gas plants risked generation disruptions, he suggested.

The Environmental Question

Responding to a reporter’s question about environmental rules and climate change science, Bailey offered that eight or nine EPA rules have affected the coal fleet, and that the mercury rule perhaps had the most impact on retirements. But though the Trump administration has proposed to roll back the Clean Power Plan, “there’s probably less debate now over whether it should be replaced than I would have thought,” he said.

A likely reason, he noted, is that the U.S. power sector is 90% on its way to achieve a 32% reduction in greenhouse gas emissions targeted by the Obama administration. Another is that generators are abiding by state environmental policies.

For the coal industry, which has complied with many environmental rules, it “really comes down to what’s the cost” in the end, said Khani.

“If you look at what’s changed on the coal fleet, you’ve had extremely tight emission standards, which has been good for all of us because the air is a lot cleaner because of it,” he said. “But the runway has been set so that the power companies can spend the dollars and get better and better. So, the question is, from a carbon perspective, how can we remove carbon beyond just not using carbon? So, if we don’t use carbon, what’s the alternative? Can we run our grid on renewables? It’s a big question,” he said.

—Sonal Patel is a POWER associate editor (@sonalcpatel, @POWERmagazine)

The post Experts: Warfare Between Coal and Gas Is Nonexistent appeared first on POWER Magazine.