The post Power Infrastructure Prominent in Biden’s $ 2.25 Trillion Blueprint appeared first on POWER Magazine.

A major chunk of President Joe Biden’s $ 2.25 trillion transformational plan to overhaul the nation’s infrastructure is dedicated to re-energizing America’s power infrastructure. The initiatives garnered the industry’s approval—with notable exceptions.

The “American Jobs Plan,” released on March 31, strives to jumpstart the U.S. economy, which drooped under burdens posed by the COVID-19 pandemic. But according to senior administration officials, forward-looking initiatives unveiled on Wednesday are also “about focusing on how can we make a historic capital investment in America to improve our competitiveness, create millions of jobs, rebuild our infrastructure, and position our economy to face the crises and the threats we will face in the future, and finally address the climate crisis as a nation.”

Along with initiatives to fix highways, rebuild bridges, upgrade ports, airports, transit systems, drinking water systems, digital infrastructure, and public institutional infrastructure, the plan seeks to revitalize manufacturing, secure U.S. supply chains, boost research and development (R&D) funding, and generally safeguard citizen health and welfare. But it also proposes to reverse a number of Trump-era initiatives, seeking, for example, to set the corporate tax at 28%, and enacting a minimum tax on large corporations’ book income.

Crucially for the power industry—which has for decades called for holistic modernization of the bulk power system to enable more efficient and reliable power generation and delivery as market and policy forces transform all parts of the sector—the plan focuses on electrification, resilience, decarbonization, infrastructure efficiency, and energy and environmental justice. As part of the president’s drive to address climate change, the plan also proposes closing tax loopholes for fossil fuel, buttressing carbon capture, and boosting hydrogen demonstrations with a new production tax credit (PTC).

Following are details of the president’s most notable power infrastructure initiatives released on Wednesday. Industry reactions are collected at the end of this article.

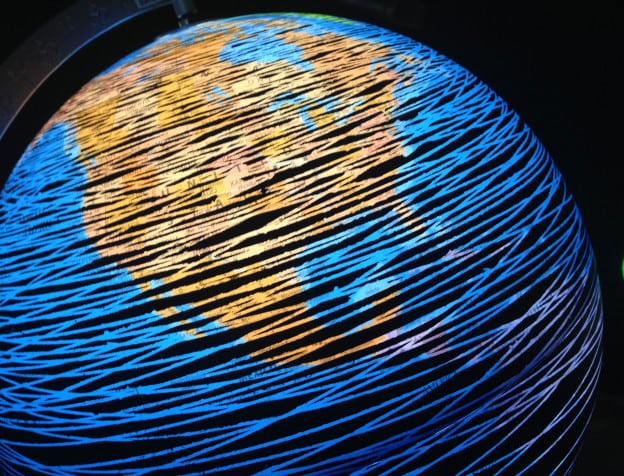

Resilience Is a Major Focus. The plan cites the 2021 Winter Storm Uri power outages in Texas and the central U.S. as an impetus for “urgent modernization” of the aging U.S. grid, but supports that claim with an outdated figure, likely from 2012, that claims power outages cost $ 70 billion annually. (In a recent report, researchers from UT-Austin and Lawrence Berkeley National Laboratory concluded the full economic costs of big power outages is complex and incomplete.) The president’s plan urges Congress to invest $ 100 billion to modernize power generation and build a more resilient transmission system.

Urgently Needed: High-Voltage Transmission. Among measures proposed are creation of a targeted investment tax credit (ITC) that incentivizes buildout of 20 GW of high-voltage capacity power lines—but it also calls for mobilization of “tens of billions in private capital off the sidelines—right away.” Biden’s plan also proposes to establish a new Grid Deployment Authority under the U.S. Department of Energy that better leverages existing rights-of-way (along roads and railways) and supports creative financing tools to spur additional “high priority, high-voltage transmission lines.”

Modernized Power Generation. The plan proposes a 10-year extension and phase down of an expanded “direct-pay” ITC and PTC for clean energy generation and storage to ramp up private investment in the power sector. The administration also plans to support state, local, and tribal governments through mechanisms like “clean energy block grants” and 100% clean energy federal purchasing power to drive clean energy deployment.

Notably, the plan says that to help meet Biden’s proposed 100% carbon-free power target by 2035, the president will establish an Energy Efficiency and Clean Electricity Standard (EECES). That measure will “increase competition in the market,” but also incentivize “more efficient use of existing infrastructure, and continuing to leverage the carbon pollution-free energy provided by existing sources like nuclear and hydropower.”

As significantly, however, is that the plan emphatically moves to eliminate “tax preferences” for fossil fuels. “The current tax code includes billions of dollars in subsidies, loopholes, and special foreign tax credits for the fossil fuel industry,” it says. “As part of the President’s commitment to put the country on a path to net-zero emissions by 2050, his tax reform proposal will eliminate all these special preferences,” it says. “The President is also proposing to restore payments from polluters into the Superfund Trust Fund so that polluting industries help fairly cover the cost of cleanups.”

Hydrogen and Carbon Capture Demonstrations in ‘Distressed’ Communities. The plan seeks to focus new energy development in “overburdened” communities. Notably, it calls for pairing 15 hydrogen demonstration projects with a new PTC, an initiative that it says could “spur capital-project retrofits and installations that bolster and decarbonize our industry.” The plan will also establish 10 “pioneer” facilities that demonstrate carbon capture retrofits for large steel, cement, and chemical production facilities (not power plants). Under the bipartisan Storing CO2 and Lowering Emissions (SCALE) Act, the plan also backs large-scale sequestration efforts.

Especially of note is that the plan looks to accelerate carbon capture and storage deployment through a reform and expansion of the Section 45Q tax credit. The reforms would make the credit direct pay and “easier to use for hard-to-decarbonize industrial applications, direct air capture, and retrofits of existing power plants.”

A Focus on Electrification. The plan calls for targeted tax credits, federal funding, and grants to improve building energy efficiency, but it focuses more heavily on transportation electrification, including to boost the U.S. market share of plug-in electric vehicle (EV) sales. The plan proposes a $ 174 billion investment to “win the EV market,” presumably from China. The plan envisions a build out of a national network of 500,000 EV chargers by 2030. It also establishes a target of replacing 50,000 diesel transit vehicles, 20% of school buses, and most of the federal vehicle fleet.

Heavy Focus on R&D, Launch of ARPA-C Appears Imminent. The plan calls on Congress to invest aggressively in technologies of the future. It calls on Congress to invest $ 50 billion in the National Science Foundation (NSF), creating a “technology directorate” that will collaborate with and build on existing programs across the government to focus on fields like semiconductors and advanced computing, advanced communications technology, advanced energy technologies, and biotechnology.

The plan also calls on Congress to invest $ 35 billion in R&D efforts that address the climate crisis. That funding will presumably help launch the Advanced Research Projects Agency-Climate (ARPA-C) program. The plan envisions investment of another $ 15 billion in demonstration projects for climate R&D, including: “utility-scale energy storage, carbon capture and storage, hydrogen, advanced nuclear, rare earth element separations, floating offshore wind, biofuel/bioproducts, quantum computing, and electric vehicles.”

Federal Purchases of New Technology, Like Advanced Reactors. Also notable is that it envisions a ramp up of clean energy manufacturing through procurement by the federal government, which spends more than a half-trillion dollars buying goods and services each year. The plan calls on Congress to enable manufacture of EVs, charging ports, electric heat pumps, and clean materials, as well as new technologies, like advanced reactors and fuel, through a $ 46 billion investment in federal buying power.

“By doing that on a forward basis, even if the delivery timeframe is over a 12-, 18-, or 24-month timeframe, you’ve created a demand pull to actually strengthen the incentive to build domestic capacity,” a senior administration official explained to reporters on Tuesday.

A Resilient Workforce. The plan is heavy on job creation. One effort calls for a $ 10 billion investment to create a “Civilian Climate Corps” to work on conserving public lands and waters.

Revitalization of Brownfield and Superfund Sites. The plan calls for a $ 5 billion investment in the remediation and redevelopment of brownfield and superfund sites—“hundreds of thousands of former industrial and energy sites [that] are now idle”—into “new hubs of economic growth and job creation.” The plan says, for example, that the administration will spur targeted efforts through the Appalachian Regional Commission’s POWER (Partnerships for Opportunity and Workforce and Economic Revitalization) grant program, an initiative that supports coal-impacted communities.

Digital Infrastructure. The plan proposes to bring affordable, reliable, and high-speed broadband to every American through investments of $ 100 billion that will prioritize a “future proof” broadband infrastructure in underserved areas. But it also seeks to promote transparency and competition among internet providers, including “by lifting barriers” that prevent municipally owned or rural co-ops from competing on an “even playing field” with private providers.

Industry Reactions Positive, with Notable Exceptions

The power sector showed overwhelming enthusiasm for the American Jobs Plan, though some sub-sector trade groups urged the Biden administration to do more.

Renewables groups were predictably jubilant. Gregory Wetstone, president and CEO of the American Council on Renewable Energy, said as one of its most important measures, the plan would “move the clean energy sector beyond the endless cycles of temporary stopgap incentives toward a stable, long-term tax platform that will put millions of Americans back to work, upgrading our outdated grid and building a 21st century renewable energy economy. The direct pay option for renewable generation credits will go a long way toward accelerating the deployment needed to decarbonize the power sector by 2035, and new incentives for transmission and energy storage will be key to securing a more reliable, efficient and cleaner electric power grid.”

On the nuclear front, the American Nuclear Society—an international professional organization of nuclear engineers and scientists—applauded the plan for recognizing that both existing and advanced nuclear energy “needs to be supported and expanded if our power grid is to successfully decarbonize by 2035.” In a joint statement, ANS President Mary Lou Dunzik-Gougar and CEO/Executive Director Craig Piercy welcomed the plan’s shortlisting of advanced nuclear among other technologies for eligibility to receive demonstration project funding and calling for the use of federal buying power to facilitate domestic manufacturing of critical technologies like advanced nuclear. They also commended the plan’s proposed clean electricity standard.

The Nuclear Innovation Alliance, a group that backs advanced reactor development, also lauded the plan’s embrace of nuclear’s future role. “As described in our U.S. Advanced Nuclear Energy Strategy, advanced nuclear power can reduce carbon emissions, bring high-paying jobs, and increase the competitiveness of American companies in global markets,” said Executive Director Judi Greenwald. “In addition to complementing wind and solar in decarbonizing the power sector, advanced nuclear can reduce emissions across the economy through industrial heating, process heating, and hydrogen production.”

The Energy Storage Association hailed Biden’s push for resilience. “From factory to grid to frontline communities, it has the policies needed to achieve our goal of 100 GW of new energy storage by 2030 to decarbonize our power system, make our infrastructure resilient and put Americans in every state to work in a globally competitive industry,” said interim CEO Jason Burwen.

Also jubilant was the Carbon Capture Coalition. The group’s director, Brad Crabtree, said: “Not only does this initial plan prioritize carbon capture technologies, it emphasizes carbon capture’s essential role in both achieving net-zero emissions and meeting midcentury climate goals and preserving and growing America’s high-wage jobs base in energy, industry and manufacturing.” Bradtree said the plan prominently features key policy recommendations cited in the coalition’s 2021 Federal Policy Blueprint, including direct pay for the Section 45Q tax credit, which is the coalition’s “top priority.”

Rob Gramlich, president of Grid Strategies, noted the recognition of transmission as a leading opportunity was also encouraging. “The transmission tax credit and other policies in the Biden infrastructure plan will enable a couple dozen large scale transmission projects to move forward in the near term,” he said. However, he added: “The biggest barrier to large scale transmission, even more than siting and permitting, is that there is currently no functioning way to recover costs of the large scale interregional ‘highways’ that we need, through electricity rates or otherwise. We appreciate this administration’s focus on deployment and the promise of a Grid Deployment Authority.”

From a business perspective, most stakeholders said the forward-leaning, technology-inclusive proposal was encouraging. Lisa Jacobson, president of the Business Council for Sustainable Energy, noted, “The ambition of this policy package will send investment signals to American and international businesses to develop the next generation of sustainable technologies.”

Tom Kuhn, president of the Edison Electric Institute (EEI), a trade group representing all U.S. investor-owned electric companies, said EEI’s member companies were “pleased” at the policies that would encourage investment in clean energy technologies, the energy grid, EV charging, and middle-mile broadband.

The power sector was at the center of the energy transition, Kuhn noted: “Across the country, EEI’s member companies are leading by example on clean energy and are committed to getting the energy they provide as clean as they can as fast as they can, without compromising on the reliability and affordability that our customers value. Today, nearly 40% of the nation’s electricity comes from carbon-free sources, and carbon emissions from the U.S. power sector are at their lowest level in more than 40 years—and continue to fall.” EEI said it would work with Congress to build consensus to advance these measures.

National Rural Electric Cooperative Association CEO Jim Matheson also listed a number of provisions that could benefit electric co-ops and their consumer members. These include a measure allowing electric co-ops to access direct-pay tax credits for energy innovation, generation, and storage programs, as well as measures to expand transmission, emerging technology demonstration, and resilience measures.

Steven Nadel, executive director of the American Council for an Energy-Efficient Economy, too, hailed the sweeping plan as a much-needed and highly overdue step in the right direction. “Too much of today’s outdated infrastructure just doesn’t work for us. We live and work in buildings that waste energy and often risk health and productivity; we use inefficient vehicles that often provide poor mobility choices or unreliable freight movement; and we have underinvested in our industrial plants and workers, at times making us vulnerable to foreign competitors and disruptions in global supply chains,” he said. “This plan would be a big step toward meeting our economic and climate challenges.”

Representing the sector’s digitalization front, global tech trade association ITI’s president and CEO, Jason Oxman, said the plan offered a “solid foundation” for future growth. He also lauded Biden’s focus on securing the U.S. supply chain through investments in domestic semiconductor manufacturing, and on R&D in emerging technologies. However, he warned, the investments should not come at the expense of weakening the U.S.’s internationally competitive tax policies. “These tax policies promote growth in high-skilled, highly paid jobs, incentivize domestic investments, and enable the United States’ most innovative companies to remain globally competitive in developing and delivering products and services throughout the world,” he said.

Sasha Mackler, director of the Bipartisan Policy Center’s Energy Project, noted a winning point in the plan is that it provides a holistic approach to net-zero emissions by 2050. “These provisions are crucial to reducing costs, improving productivity, and creating new markets for America’s existing industries, including those in transport, heavy manufacturing, and many other sectors,” she said.

Armond Cohen, executive director of climate action advocacy group Clean Air Task Force, also hailed the broad scope. “In order to tackle the climate crisis, we need to rapidly develop and scale a broad array of critical zero-carbon technologies,” he said. “President Biden’s new jobs and infrastructure plan harnesses the power of the U.S. government to do just that—incentivizing clean energy development and providing critical support for much-needed decarbonizing technologies like carbon capture and storage, zero-carbon fuels, and advanced nuclear energy.”

Yet, some industries felt left out. In a joint statement, a coalition of water infrastructure and agricultural entities reiterated a call for investments to support a diversified water management portfolio that enhances water supply and quality for urban and environmental uses, while keeping water flowing to Western farms and rural communities. The alliance said it was working with the administration to address a “larger need for Western water infrastructure, such as above- and below-ground water storage facilities, conveyance and desalination, along with federal financing mechanisms for such water projects.”

Fossil fuel interests, too, were notably deflated. Frank Macchiarola, senior vice president at the American Petroleum Institute—the group that represents all segments of the oil and natural gas industry—said the organization backed the administration’s infrastructure modernization goals, especially to benefit transportation, as well as its incentives for hydrogen and carbon capture. “At the same time, this proposal misses an opportunity to take an across-the-board approach to addressing all our infrastructure needs—including on modern pipelines,” he said.

He also noted that hitting specific industries with new taxes would undermine the economic recovery. “It’s important to note that our industry receives no special tax treatment, and we will continue to advocate for a tax code that supports a level playing field for all economic sectors along with policies that sustain and grow the billions of dollars in government revenue that we help generate,” he said.

—Sonal Patel is a POWER senior associate editor (@sonalcpatel, @POWERmagazine).

The post Power Infrastructure Prominent in Biden’s $ 2.25 Trillion Blueprint appeared first on POWER Magazine.